Investment in the euro area, and particularly private investment, has not recovered since the onset of the global financial crisis.

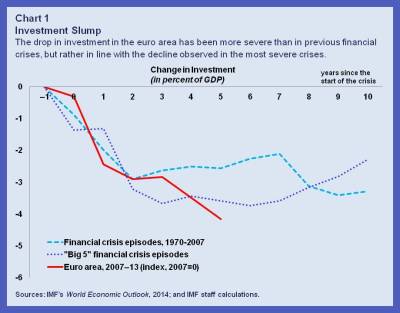

In fact, the decline in investment has been much more drastic than in other financial crises; and is more in line with the most severe of these crises (see Chart 1). TheOctober 2014 World Economic Outlook showed that many governments cut investment because their finances became strained during the crisis. In addition, housing investment collapsed in some countries, reflecting a natural scaling back after an unsustainable boom. But what is holding back private non-residential investment?

In an IMF Working Paper, we have looked at the driving factors of private non-residential investment in seven euro area countries – Germany, France, Spain, Italy, Ireland, Portugal and Greece – and the euro area as a whole until 2013. We find that low growth is definitely a big part of the story. But crisis legacies, such as high corporate leverage, financial constraints, and policy uncertainty are also holding back investment in some countries.

A vicious “Catch 22”

Much of the dip in investment since the crisis can be explained by low or negative growth. Effectively, this creates a “Catch 22”: growth is weak partly because investment is low, but investment is low because companies don’t have sufficient demand for their products. The shortfall in investment dims both short- and medium-term prospects for the euro area. Countries need higher investment to raise demand now, increase the productive capacity of their economies, and secure permanently higher incomes. Yet, without higher demand, firms are unwilling to invest.

This is particularly true for Spain, where changes in real GDP explain the variation in investment well. But in many euro area countries, investment has declined by more than suggested by the changes in output since the beginning of the euro area debt crisis.

… reinforced by crisis legacies

So what other factors are at work? In some countries, investment is too low because of high corporate debt, policy uncertainty, and borrowing constraints.

Uncertainty makes firms more wary about investing in future capacity, and has been an important factor holding back investment in several of the countries, such as Spain, Italy, Greece, and Ireland, as well as in the euro area as a whole.

Similarly, higher indebtedness impairs firms’ credit worthiness and ability to borrow and invest, reducing investment in Portugal, Italy and France, particularly during stressed periods.

A very difficult borrowing environment, especially access to bank finance is also impeding investment in Italy and Portugal. On the other hand, some firms finance investment by their own cash streams, with higher cash inflows associated with more investment in Spain and Germany.

The significance of these other factors in explaining investment in some countries since 2010 becomes clearest when comparing the cumulative difference between the predicted and the actual level of investment, i.e., the unexplained shortfall in investment.

While the cumulative difference between investment predicted by output changes alone and its actual level ranges between 3 and 6 percent of GDP, this shortfall narrows to ½ -2 percent of GDP when taking into account the other factors mentioned above, such as uncertainty, indebtedness, borrowing costs, cash buffers, and financial constraints. (see Chart 2).

In Italy and Portugal, for example, the unexplained shortfall in investment thus declines from about 6 percent of GDP to less than 1 percent of GDP.

What does this imply for policy? First, investment should pick up as the recovery strengthens. As outlined in the last year’s staff report on the euro area, continued accommodative monetary policy and the use of available fiscal space at the national level should help support investment by raising current demand.

But demand support is not enough to stimulate investment. Our analysis confirms that corporate indebtedness impedes investment and that dealing with the debt overhang and high non-performing loans should be a priority. Firms also need better access to capital, and at a lower cost. Completing the banking union and building a capital markets union would increase the prospects of boosting investment.

In addition to making financial intermediation more effective, more flexible labor and product markets and reforms to improve the business environment would also raise investment by raising growth expectations. Overall, a comprehensive policy effort would reduce policy uncertainty, revive the animal spirits, and contribute to a sustained recovery in investment.

This article is published in collaboration with IMF direct. Publication does not imply endorsement of views by the World Economic Forum.

To keep up with the Agenda subscribe to our weekly newsletter.

Author: Bergljot Bjørnson Barkbu is the IMF’s Deputy Resident Representative to the European Union.

Image:European Union flags fly outside the European Commission headquarters in Brussels. UNICS REUTERS/Thierry Roge. Hanni Schölermann is an Economist at the IMF Europe Office in Brussels. S. Pelin Berkmen is a senior economist in the European department, where she works on the euro area.

No comments:

Post a Comment