Bitreserve Brings Bitcoin To The Gold Standard

The bitcoin-based financial services company Bitreserve is merging one of the newest innovations in currency with the world’s oldest.

Through the institutional precious metals trading house Gold Bullion International, Bitreserve has created a new gold standard, linking its bitcoin currency exchange and payment services with gold.

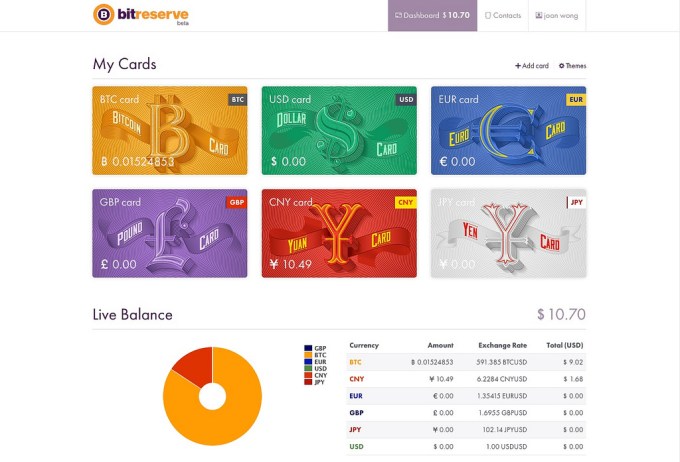

Now, using Bitreserve, customers can hold gold in their accounts and convert it to bitcoin to buy goods and services.

“I’ve never had a gold crush before,” says Bitreserve chief executive Halsey Minor, a serial entrepreneur who has made — and lost — hundreds of millions of dollars in technology and real estate investments. “After you go and you’re in that world you can kind of see why people are a little bit crazy about gold.”

Minor sees the integration of gold and bitcoin as the latest step in his company’s push to make bitcoin more mainstream.

The idea, he says is to allow users to hold their money in the currency they think is most stable, and convert it into bitcoin to make transactions. Bitcoin itself is too volatile for an everyday consumer to use as their only medium for exchange, but the benefits of its payment platform is undeniable to merchants — and, Minor says, consumers too.

“People don’t want to hold their currency in a wildly volatile form,” says Minor. “We allow them to hold value in the way that goods and services are priced.”

In a blog post on the company’s site, Bitreserve’s president of global strategy and markets writes:

With our Gold Card, we are reviving gold for the purchase of goods and services. Bitreserve members can convert their bitcoin to bitgold, whose value is substantiated by bullion in our reserve, but still spend it as bitcoin. By creating a bridge between the revolutionary Bitcoin protocol and good old gold bullion, we enable our members to instantly send or spend bitcoin from the ounces of gold held in their Bitreserve wallet.

Gold is only one of the currencies Bitreserve customers can use to store value. The company charges a 0.45% fee to convert currencies like dollars, yuan, yen, euros, and pounds into bitcoin and back again, compared to 8% to 10% conversion fees from a traditional financial institution. The charges associated with converting from bitcoin to gold are higher, at 1.95% because Bitreserve is buying and holding the physical asset.

In fact, the company has roughly $50,000 worth of gold that it has purchased so far, and will hold more as more members begin using its gold standard, Minor says.

“The idea that gold can be used on the instantaneous rails of modern commerce [means] that you don’t just have to hold bitcoin for this to work. People can hold value in whatever form they feel comfortable with and still use the power of bitcoin as an open commercial platform,”Minor says.

In some ways, Minor’s brush with bankruptcy led him to launch Bitreserve to be a transparent platform where assets are completely verifiable. The company displays every transaction on its network and the amount of money generated from transaction fees.

“The most important thing in how it’s working is transparency,” says Minor. “How we hold the money and what we hold at any given moment in time is completely transparent.”

To that end, the company has also made its fundraising process public. Bitreserve is in the process of closing a $10 million financing round using the crowdfunding site Crowdcube. The new investment follows a $5 million Series A round, which closed in March.

Minor and the rest of his team at Bitreserve think the key issue around increasing bitcoin adoption is fungibility. It’s not bitcoin as the currency itself that has value, but the ability for bitcoin to be substituted for fiat currencies in transactions that matters.

Or — as Bitreserve’s Parsa puts it — “With the Gold Card you can hold value like my man King Croesus, but spend it like Satoshi Nakamoto.”

bitcoin.org

No comments:

Post a Comment